Introduction

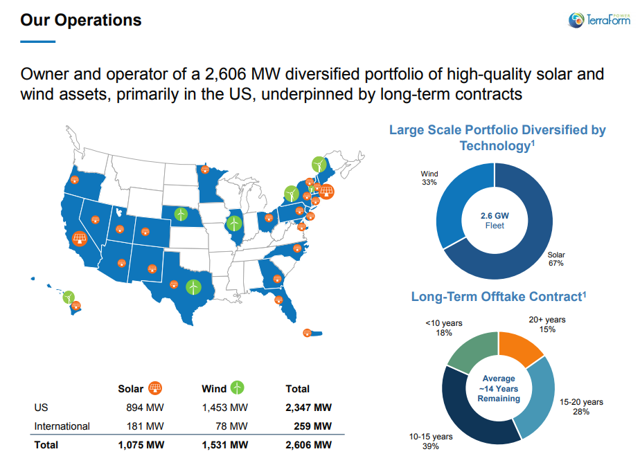

TerraForm Power (TERP) is an owner and operator of renewable power comprising of both wind and solar assets totaling just over 2,600 megawatts on installed capacity. Most of these assets are located within the United States.

Recently the company announced an offer to buy Saeta, a Spanish renewable energy company, which is expected to positively impact TERP's CAFD by 24%.Along with potential promising growth on the horizon, the company increased the quarterly dividend to $0.19, resulting in a forward yield of 6.76%. Unfortunately, the most recent earnings results did not impress Goldman Sachs (GS), who has recently downgraded and placed an $11 price target on TERP. I still believe that TERP is a long-term buy based on the company’s potential growth, long term trends in the sector of renewables, and with oversight and strong management from Brookfield despite the latest rating from the analyst at Goldman Sachs.