Summary

- The market has left Iridium behind a little during the current bounceback.

- We suspect this is due to the negative news around OneWeb, a satellite business which has just filed for bankruptcy.

- Iridium stock may have been caught in the backwash. But Iridium is a growing, predictable, cash generative business and its stock is on sale.

- In addition, it is one of the companies whose earnings we expect to be impacted least by Covid-19.

- We're at Buy as a result.

- Looking for a helping hand in the market? Members of The Fundamentals get exclusive ideas and guidance to navigate any climate. Get started today »

DISCLAIMER: This article is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this article is not an offer to sell or buy any securities. Nothing in it is intended to be investment advice and it should not be relied upon to make investment decisions. Cestrian Capital Research Inc or its employees or the author of this article or related persons may have a position in any investments mentioned in this article. Any opinions or probabilities expressed in this report are those of the author as of the article date of publication and are subject to change without notice.

A Brief Introduction

Iridium Communications (IRDM) is a not-all-that-well-known and not-very-exciting business whose stock has been very good to us. The company operates a high-reliability global satellite network used by government, military, first responder and maritime customers. Its largest customer, by far, is the US Department of Defense.

We've covered the stock extensively here on SA - you can see our prior work here. We encourage you to read some or all of our prior notes - there's a lot of material there covering many aspects of the business and its evolution in the last year or two - we have a high level of confidence in the company and its stock, and we think you will understand from our notes why we feel that way.

Iridium Is A Buy At These Levels

Our key message today is short, simple and sweet: the stock is a Buy at these levels.

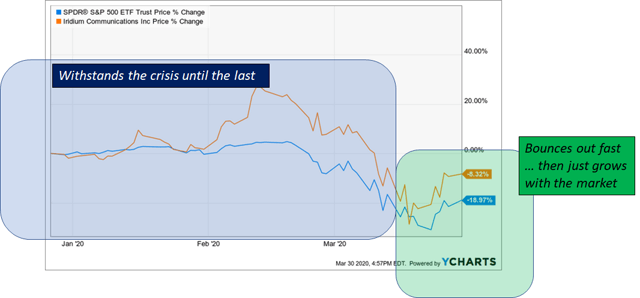

This is what's happened to the stock during the Covid-19 collapse and bounceback so far, vs. the S&P500.

Source: YCharts.com

The stock held up better than the market at large until the start of the final leg down; it then moved up as the market fell and has kept rising since that time. So far so good. But in the last 2-3 days the stock price growth has simply kept pace with the market. And that strikes us as a buying opportunity.

On the one hand, you might argue, it is the very predictability of the revenue line here that means the market will rise faster than the stock when in recovery mode. Right now we are in a risk-on period and investors are looking for beta; traditionally beta means high growth companies; and IRDM is a grower but only high single digits revenue growth, ergo, no growth premium vs the market at this time. And in normal times we would likely agree with you. But these are not normal times.