Summary

- A "cloudy" future lies ahead, but that's good news for data center REITs. The physical epicenter of the "cloud," data centers have been the best-performing property sector amid the pandemic.

- Clear winners of the work-from-home era, corporations will increasingly shift spending on physical office space towards "digital office space" through investments in remote-work infrastructure.

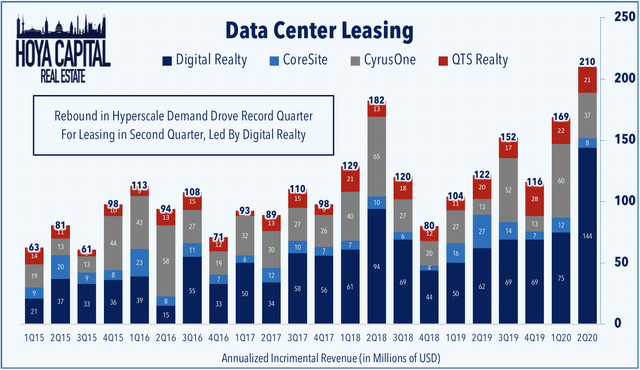

- Leasing activity - the most closely-watched earnings metric - surged in the second quarter to the highest level on record as the sector continues to ride substantial secular tailwinds.

- Battle For the Clouds. Risks remain as intense competition from the hyperscale giants – Amazon, Microsoft, and Google - and relentless supply growth have weakened pricing power and AFFO growth.

Data center REITs have made the right moves to fend-off competitive threats through consolidation and internal development. While expensive, the "essential" property sectors - technology, housing, and industrial - are the lone areas of reliable growth within the REIT sector.

This idea was discussed in more depth with members of my private investing community, iREIT on Alpha. Get started today »

REIT Rankings: Data Centers

(Hoya Capital Real Estate, Co-Produced with Brad Thomas)

Data Center Sector Overview

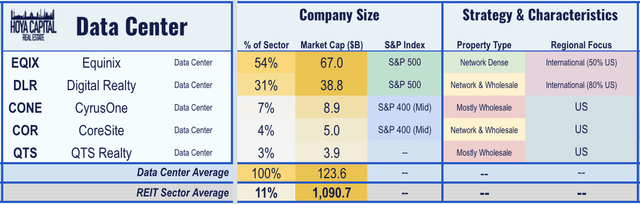

A "cloudy" future lies ahead, but that's good news for data center REITs. Data centers are the home of the "cloud," the physical epicenter of the internet. Within the Hoya Capital Data Center Index, we track the five data center REITs, which account for roughly $125 billion in market value and own nearly 600 data centers across the world: Equinix (NASDAQ:EQIX), Digital Realty (NYSE:DLR.PK), CyrusOne (CONE), CoreSite (COR), and QTS Realty (QTS). While not included in the index, business storage operator Iron Mountain (IRM) also operates a relatively small portfolio of data centers as well as non-REITs Switch, Inc. (SWCH) and RackSpace (RXT).

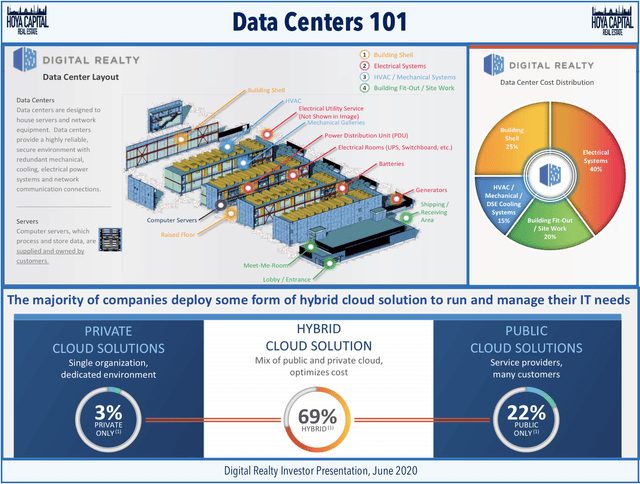

Clear winners of the "work-from-home" era and COVID-related social and economic shifts, data center REITs have thrived amid the disruption. In an increasingly virtual world, data centers are the essential infrastructure that prevented a catastrophic drop in productivity amid the coronavirus-related economic shutdowns by enabling the relatively seamless transition to the "work-from-home" era. Housed in windowless buildings surrounded by massive generators and cooling equipment, data centers provide the critical infrastructure - power, cooling, and physical rack space - to a variety of enterprise customers with different networking and computing needs. Data centers enable high-speed networking and house millions of terabytes of mission-critical data for thousands of individual customers.

As we'll explain throughout this report, we view the "essential" property sectors - technology, housing, and industrial/logistics - as the lone areas of reliable growth within the REIT sector over the next half-decade. On that point, leasing activity, the most closely-watched earnings metric for data center REITs, surged in the second quarter to the highest level on record as the sector continues to ride substantial secular tailwinds associated with the shift in spending from physical office space towards "digital" space. Together, these REITs combined to report $210 million in incremental leasing activity, representing a 72% jump from 2Q19, highlighted by Digital Realty's best quarter on record with incremental leasing revenues of $144 million.