Summary

- Biogen had a dramatic day, after years of flip-flop, as it appears the company's new Aducanumab drug will be approved.

- Even outside of Aducanumab, the company has continued to perform well, with an efficient balance sheet and impressive portfolio.

- Long-term, Biogen is an undervalued company with the ability to generate valuable long-term shareholder returns.

- I do much more than just articles at The Energy Forum: Members get access to model portfolios, regular updates, a chat room, and more. Get started today »

Worldwide, 44 million people have Alzheimer's. In the U.S., an estimated 5.5 million people have it, including more than 5 million above 65. That's more than 10% of those above 65. With the world's aging position expected to increase significantly, this proportion will increase significantly. Alzheimer's currently has no FDA approved treatments.

That's why, based on Biogen's (NASDAQ: BIIB) announcement of likely approval of its new Alzheimer's drug, the company's share price increased by 44%, a $16 billion market capitalization increase.

Aducanumab Results Update

The FDA and Biogen have announced a number of recent updates on Aducanumab.

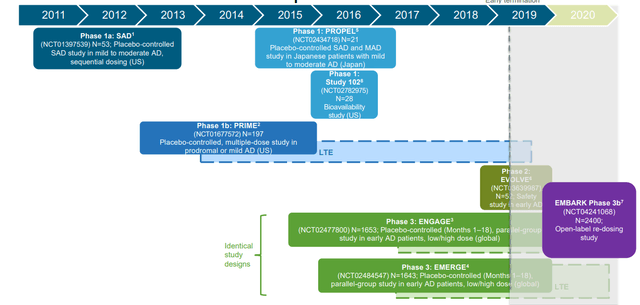

Aducanumab Clinical Development - Aducanumab Investor Presentation

The company has had a volatile share price for several years on the back of volatile news on its Aducanumab drugs. This drug is focused on targeting a plaque that forms in the brain cells of Alzheimer's patients, one of the first drugs to target it, and it has been in development for nearly a decade. Across this time it's gone through numerous studies.

However, recent FDA and Biogen results indicate that re-examining the data could lead to drug approval.