Summary

- Shares of Inovalon have not been able to recover from their drop after earnings at the end of October.

- 2020 guidance reduction was the cause of the decline, however, 2021 guidance looked very promising.

- Inovalon presents a good value in the healthcare technology space.

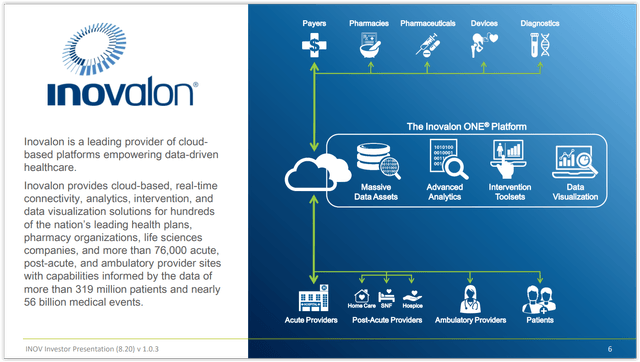

In this article, I will be covering Inovalon Holdings (INOV), which is a small healthcare information company that has been left behind from the rally in other healthcare technology companies like Veeva Systems (VEEV) and Teladoc (TDOC). I have a saved screen on Finviz that I regularly check for “good bargains,” and Inovalon caught my eye because it is not often in this market that software or technology companies make the list. For those that are not familiar with Inovalon, the company provides a cloud-based platform covering many participants of the healthcare sector to collect and analyze data. This sounds like the kind of business that should be performing very well in this environment. However, as I will show in the guidance section below, Inovalon cut its 2020 guidance, which sent the stock sharply lower at the end of October.

(Source: Company investor presentation)

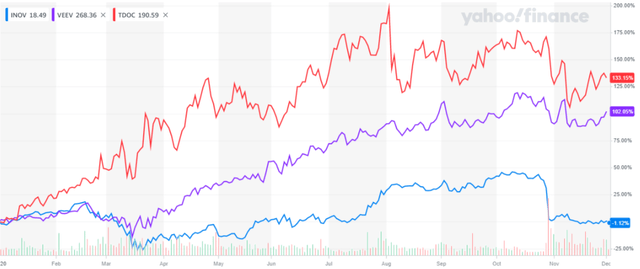

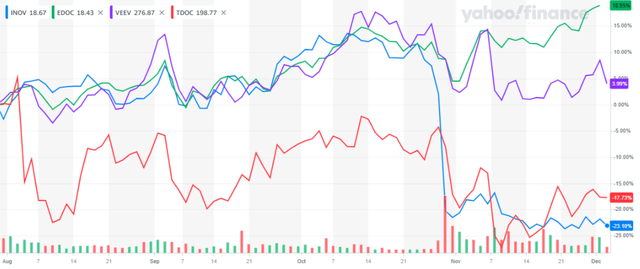

Performance Comparison

The first chart below shows that Inovalon has significantly underperformed Veeva and Teladoc since the beginning of the year. The second chart shows Inovalon compared to Veeva, Teladoc and the Global X Telemedicine & Digital Health ETF (EDOC), which launched at the end of July and owns a basket of technology-focused health care companies. Inovalon has underperformed its peers over this time as well, and I believe presents a good value after the recent sell-off due to lowering its 2020 guidance. The only reason Teladoc performed poorly since the end of July was its merger with Livongo Health (LVGO).

(Chart from Yahoo Finance)

(Chart from Yahoo Finance)