Summary

- Just because a company is among the elite of dividend growth blue chips doesn't mean they will remain a great income investment forever.

- FRT's properties are the best in the country, with the highest population density, and the highest average household incomes.

- FRT's sound liquidity position is supported by approximately $1 billion cash and $1 billion availability under its revolving credit facility.

- We maintain a buy and are also "underweight" shopping centers.

- Looking for more investing ideas like this one? Get them exclusively at iREIT on Alpha. Get started today »

This article was co-produced by Dividend Sensei.

“Dividend Record. One of the most persuasive tests of high quality is an uninterrupted record of dividend payments going back over many years. We think that a record of continuous dividend payments for the last 20 years or more is an important plus factor in the company’s quality rating. Indeed the defensive investor might be justified in limiting his purchases to those meeting this test.” - Benjamin Graham

Dividend aristocrats and kings are the most beloved of dividend stocks and for good reason:

- The most dependable source of generous, safe, and rising dividends on earth

- A great track record of outperforming the market over time

Dividend Aristocrats Since 1990

| Year | Aristocrats Returns |

| 1990 | 5.70% |

| 1991 | 38.50% |

| 1992 | 10.10% |

| 1993 | 4.30% |

| 1994 | 0.90% |

| 1995 | 34.60% |

| 1996 | 20.90% |

| 1997 | 34.50% |

| 1998 | 16.80% |

| 1999 | -5.40% |

| 2000 | 10.10% |

| 2001 | 10.80% |

| 2002 | -9.90% |

| 2003 | 25.40% |

| 2004 | 15.50% |

| 2005 | 3.70% |

| 2006 | 17.30% |

| 2007 | -2.10% |

| 2008 | -21.90% |

| 2009 | 26.60% |

| 2010 | 19.40% |

| 2011 | 8.30% |

| 2012 | 16.90% |

| 2013 | 32.30% |

| 2014 | 15.80% |

| 2015 | 0.90% |

| 2016 | 11.80% |

| 2017 | 21.70% |

| 2018 | -2.70% |

| 2019 | 28% |

| 2020 | 8.70% |

| Median Return Since 1990 | Average Return Since 1990 |

| 11.80% | 12.8% |

| Annualized Returns Since 1990 | S&P 500 Since 1990 |

| 12.30% | 10.10% |

(Source: Ploutos)

- Since 1990 aristocrats have delivered 3,310% total returns

- S&P 500 1,793% total returns

However, just because a company is among the elite of dividend growth blue chips doesn't mean they will remain a great income investment forever.

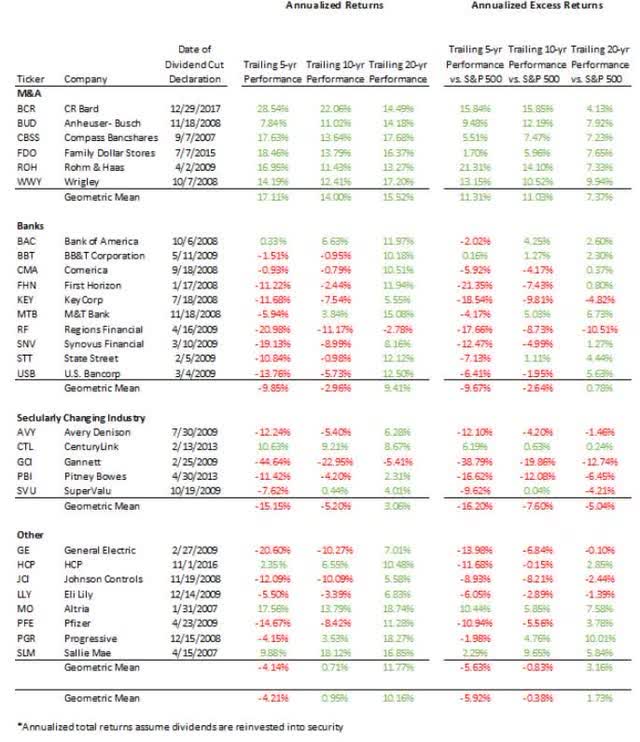

Failed Dividend Aristocrats 2008 to 2018

(Source: Ploutos) Altria is still a dividend king adjusted for three spinoffs

(Source: Ploutos) Altria is still a dividend king adjusted for three spinoffs

From 2008 to 2018 alone 28 dividend aristocrats lost their status after cutting dividends.

- Kmart and Winne-Dixie are former aristocrats that went bankrupt and their stocks to zero.

In the words of John Maynard Keynes,

"When the facts change, I change my mind, what do you do, sir?"

Neither Dividend Kings nor iREIT has any interest in recommending, much less owning ourselves, the next GE, CenturyLink, or god forbid, Kmart or Winn-Dixie.

The difference between a potentially wonderful deep value blue chip, even a speculative one, and a value/yield trap, is purely in the fundamentals.

This brings us to this update on the troubling, but far from alarming, deterioration in Federal Realty Investment Trust's (FRT) fundamental outlook.